-

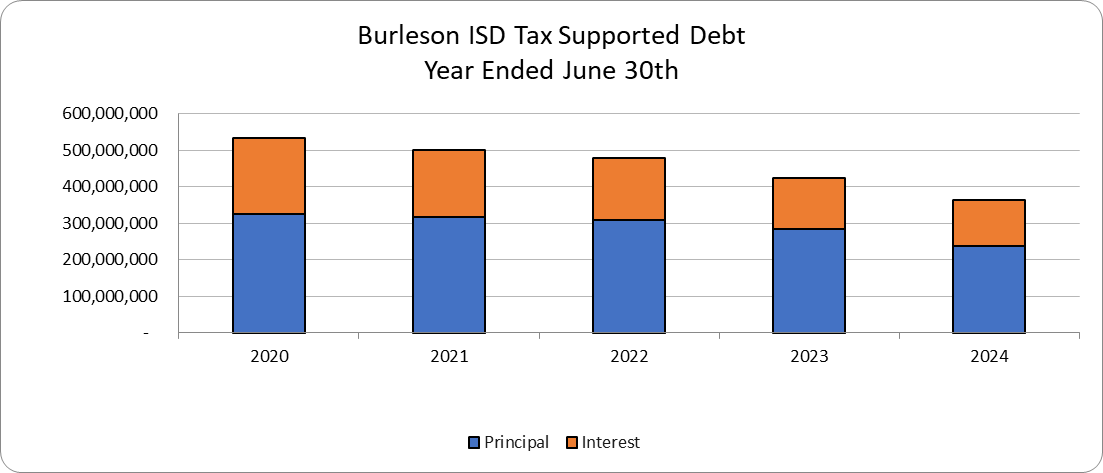

Burleson ISD's debt takes the form of tax-supported bonds. As a result of outstanding bonded indebtedness, a portion of the District tax rate (the Interest & Sinking, or I&S, portion) is devoted exclusively to servicing these debts. To increase the amount of outstanding bonded debt, the District would have to receive voter approval, through an election, before issuing any new bonds. Burleson ISD does not have any revenue-supported debt or lease-purchase/lease-revenue debt.

-

Debt Information

Required Disclosures under HB 1378

Outstanding General Obligation Debt

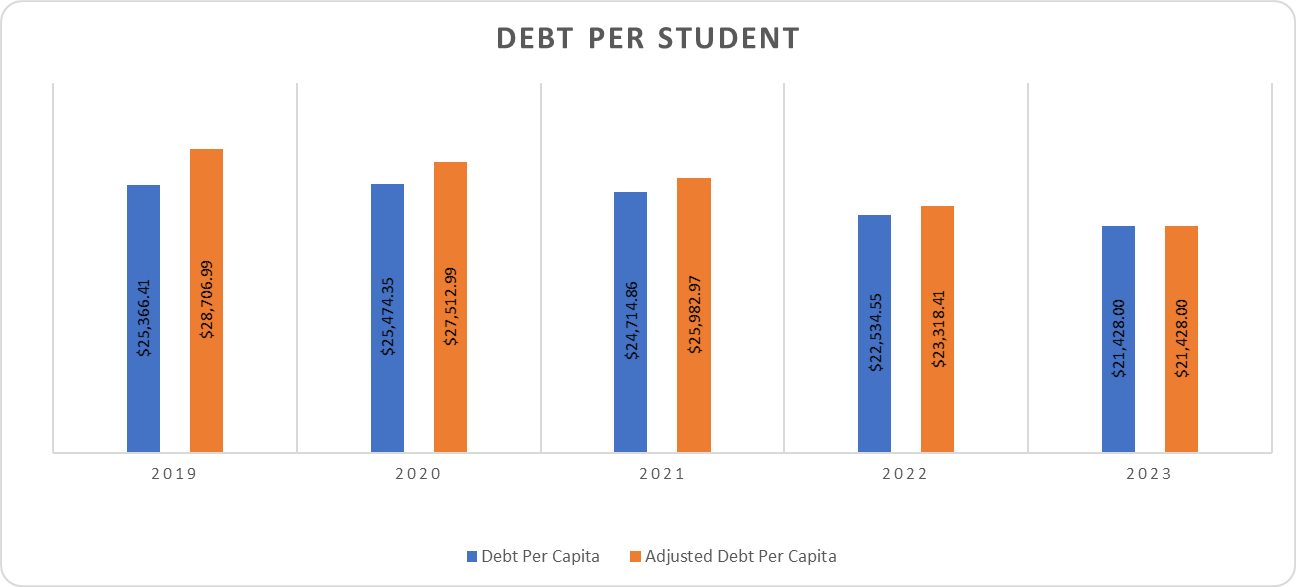

Debt Per Capita and Per Student

Debt Information for Previous Years Budget

Bond Projects - The district does not have any upcoming bond elections at this time.

Bond Review Board - Information on the local government debt data can be found on the Bond Review Board website.

-

Annual Obligation Schedule

Fiscal Year Ending Principal Interest Total Per Capita (pop 53,500) 2025 7,913,538 14,771,266 22,684,804 $ 424.02 2026 9,185,000 10,326,129 19,511,129 $ 364.69 2027 9,550,000 10,856,129 20,406,129 $ 381.42 2028 9,920,000 10,496,392 20,416,392 $ 381.61 2029 9,385,000 11,017,079 20,402,079 $ 381.35 2030-2034 70,115,000 45,101,435 115,216,435 $ 2,153.58 2035-2039 86,405,000 18,638,226 105,043,226 $ 1,963.42 2040-2044 57,455,000 3,877,702 61,332,702 $ 1,146.41 2045-2048 7,750,000 400,500 8,150,500 $ 152.35 Total $ 267,678,538 $125,484,858 $393,163,396 $ 7,196.50

-

Total Outstanding Debt Per Capita

Total Outstanding Tax-Supported Debt